The world of investments can be overwhelming...

We can help you relax.

Automated investment management. MDA robo adviser.

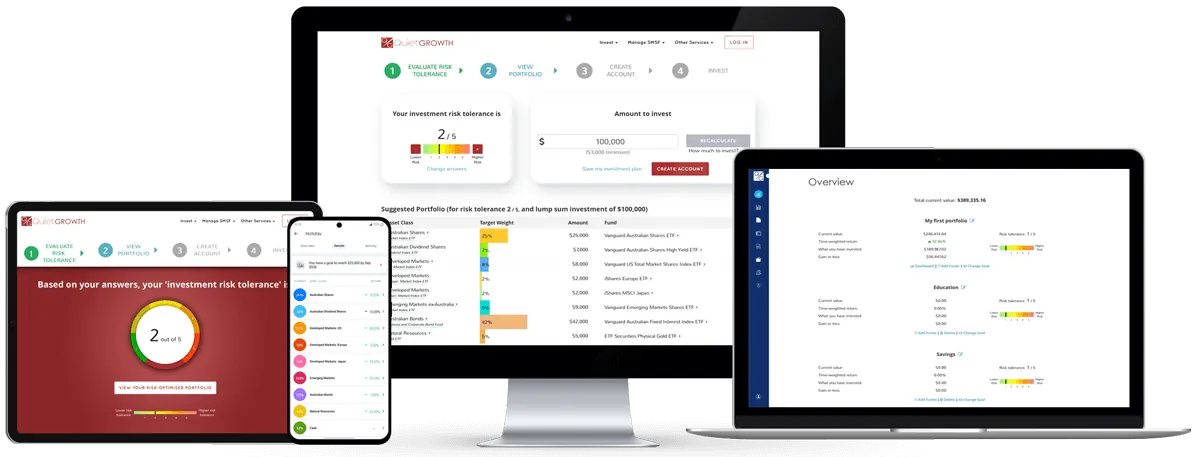

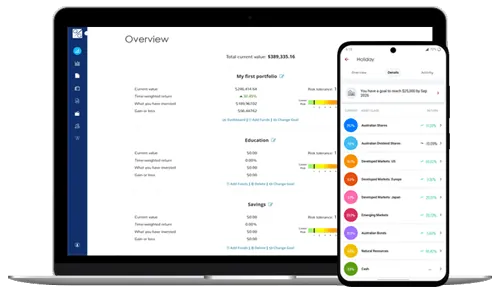

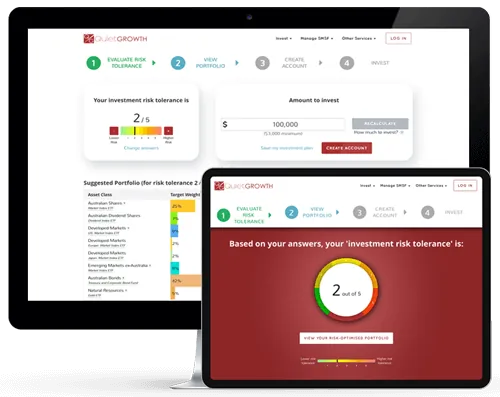

Step 1

Answer Questions

Answer few questions to evaluate your investment risk tolerance score.

Step 2

View Portfolio

Know about your diversified global portfolio of ETFs with a long-term focus.

Step 3

Create Account

Get your Statement of Advice. Sign the MDA contract to allow us to serve you. We create your brokerage account and cash account.

Step 4

Invest

Invest in your QuietGrowth portfolios. We will manage your wealth for a low QuietGrowth fee.

Answer Questions

Answer few questions to evaluate your investment risk tolerance score.

View Portfolio

Know about your diversified global portfolio of ETFs with a long-term focus.

Create Account

Get your Statement of Advice. Sign the MDA contract to allow us to serve you. We create your brokerage account and cash account.

Invest

Invest in your QuietGrowth portfolios. We will manage your wealth for a low QuietGrowth fee.

Our digital advice = Personal financial advice + Manage funds on your behalf

What we do

QuietGrowth manages your investments in individual, joint, SMSF, trust, and company accounts for risk-optimised returns. We are an automated, online investment manager. We are a financial adviser providing digital advice.

QuietGrowth manages your investments in individual, joint, SMSF, trust, and company accounts for risk-optimised returns.

We are an automated, online investment manager. For as low as 0.4% annual QuietGrowth fee, benefit from our advanced investment management service.

- Personalised investment advice

- Managed Discretionary Account (MDA) service

- Individual HIN structure for the securities

- Issue of Statement of Advice (SOA)

Most advanced 'online investment adviser' in Australia

- World class investment experts

- Client-focused, with no conflict-of-interest

- Goal-based investing option

- Sole independently-owned MDA robo adviser in Australia

What we invest in

AUSTRALIAN

SHARES

DIVIDEND

SHARES

DEVELOPED

MARKETS

EMERGING

MARKETS

BONDS

NATURAL

RESOURCES

Our investment methodology

Built on Nobel Prizes in financial economics.

- "Stock price movements are impossible to predict in the short-term"

- "New information affects prices almost immediately, which means that the market is efficient" – efficient markets hypothesis

- Influenced the development of index funds

- Maximised the expected return of a portfolio for a given amount of portfolio risk – Modern Portfolio Theory

Save your time

To do what you love to do.

To do more of what you can do better.

CAREER

FAMILY

FRIENDS

HOBBIES